In the early hours of Thursday morning, the House of Representatives passed a monumental tax cut bill, championed by President Donald Trump and his Republican allies. Dubbed “The One Big Beautiful Bill Act,” this legislation aims to enact Trump’s tax and spending priorities while adding a staggering $3.8 trillion to the US national debt over the next decade.

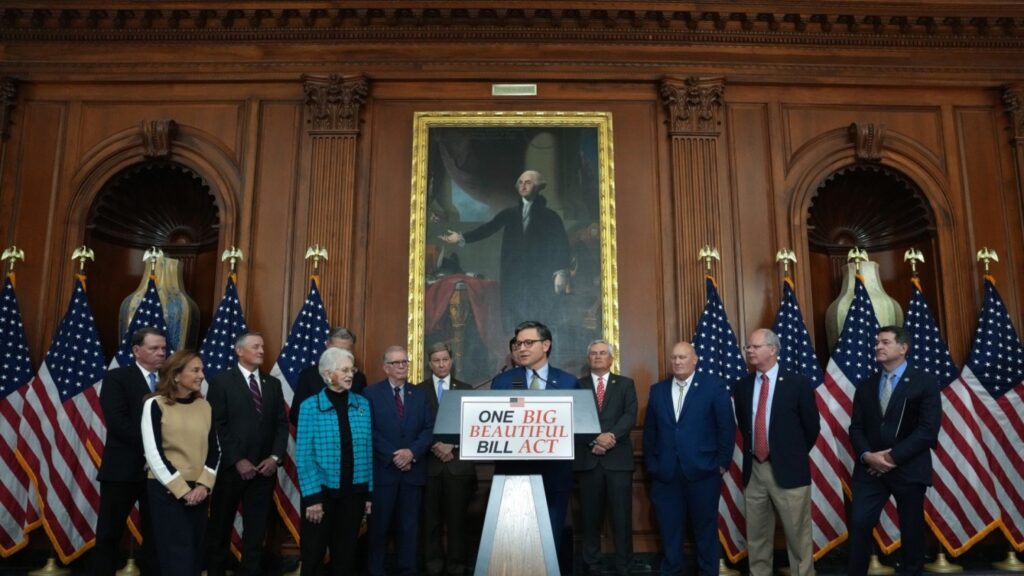

The bill, which was approved with 215 votes in favor and 214 against, marks a significant milestone for the Republican Party as it seeks to deliver on its campaign promises. Despite concerns from Democrats and some Republicans about the bill’s impact on social welfare programs and the nation’s fiscal health, House Speaker Mike Johnson hailed its passage as a testament to the power of prayer and perseverance.

“We gave glory to God,” Johnson said in a statement after the vote, acknowledging the intense negotiations that brought the party together. “There was a few moments over the last week when it looked like the thing might fall apart.”

Trump himself celebrated the bill’s passage, urging the Senate to act quickly and send the measure to his desk as soon as possible. “This is arguably the most significant piece of Legislation that will ever be signed in the History of our Country!” he exclaimed on Truth Social.

The bill boasts several key provisions, including:

- Tax cuts for individuals and corporations: The legislation extends tax cuts enacted under Trump’s predecessor, Donald Trump, and sunsets clean energy incentives put in place by Joe Biden.

- Relief for working-class Americans: The bill relieves taxes on tips, overtime, and car loan interest, offers parents $1,000 if they open “Trump accounts” for their children, and expands a deduction for older taxpayers (though only while Trump remains in office).

- Border wall funding: The legislation allocates funds for the construction of a wall along the US-Mexico border.

- Immigration reform: New staff and facilities are allocated to facilitate mass deportations of undocumented immigrants.

To offset its costs, the bill introduces funding cuts and new work requirements for Medicaid, which provides healthcare for poor and disabled Americans, as well as the Supplemental Nutrition Assistance Program (SNAP). Analysts warn that these changes could deny millions of Americans access to these vital benefits.

Despite its significant cost, the Congressional Budget Office estimates that the measure will add $3.8 trillion to the national debt over the next 10 years. This comes at a time when credit ratings agency Moody’s has already stripped the US of its top-notch triple-A rating, citing concerns about the country’s large national debt and federal budget deficit.

House Democratic leaders have vehemently opposed the bill, labeling it a “tax scam” that is “deeply unpopular.” Minority Leader Hakeem Jeffries, Whip Katherine Clark, and Caucus Chair Pete Aguilar vowed to continue fighting against the measure in the Senate.

Even Barack Obama, the 44th President of the United States, weighed in on the bill, warning that it would put millions of Americans at risk of losing their healthcare. “Right now, Republicans in Congress are trying to push through a bill that would put millions of Americans at risk of losing their healthcare,” he said. “They want to cut federal funding for Medicaid, take away tax credits that help more people afford coverage and raise costs for working-class families.”

The bill’s fate now rests with the Senate, where Republicans aim to have it on Trump’s desk by Independence Day (4 July). The journey ahead will be challenging, as disputes among Republican lawmakers themselves must be resolved. Nonetheless, the passage of this sweeping tax cut bill marks a significant milestone in President Trump’s legislative agenda and sets the stage for a crucial test of bipartisanship in the Senate.

As the bill makes its way through Congress, it is essential to keep a close eye on its implications for the American people. The One Big Beautiful Bill Act promises significant tax cuts and relief for many, but at what cost? Will the funding cuts and new work requirements for social welfare programs exacerbate existing inequalities or create new ones?

As lawmakers in the Senate deliberate, we must not forget the voices of those who will be most affected by this legislation. The concerns of healthcare advocates, low-income families, and other vulnerable communities demand attention and action.

In the coming days and weeks, it is crucial that Americans engage with their elected representatives, sharing their thoughts on this bill and urging them to consider its far-reaching consequences. As we move forward, let us strive for a more informed and inclusive national conversation about the role of government in our lives and the importance of balancing individual prosperity with the collective well-being of society.

Will The One Big Beautiful Bill Act become a reality, or will it falter under the weight of partisan divisions and fiscal concerns? Only time will tell. One thing is certain, however: this pivotal moment in American politics demands our attention, our engagement, and our voices.

Sourced from https://www.theguardian.com/

Additional Details:

Read the bill here.