A group of pension fund leaders, responsible for managing substantial investments in Tesla, have sounded the alarm, urging the company’s board to take immediate action to address the “crisis” unfolding under the leadership of its mercurial CEO, Elon Musk. The investors’ stern warning comes as a result of Tesla’s faltering stock price, declining sales, and an increasingly tarnished global reputation.

The letter, addressed to Robyn Denholm, Tesla’s board chair, highlights the company’s precarious state: “Tesla’s stock price volatility, declining sales, disconcerting reports regarding human rights practices, and a plummeting global reputation are cause for serious concern.” These issues, the investors argue, are directly linked to Musk’s actions outside of his role as Technoking and CEO at Tesla, including his high-profile involvement in the U.S. Department of Government Efficiency (DOGE) and his support for controversial political figures like Donald Trump.

The pension fund leaders demand that the board impose a minimum 40-hour workweek on Musk as a condition of any new compensation plan, ensuring he dedicates sufficient time to address the pressing issues facing the company. Furthermore, they urge the implementation of a clear succession plan for management and a policy limiting outside board commitments for all Tesla directors.

This call to action comes as no surprise, given the Delaware Court of Chancery’s 2022 decision to rescind Musk’s 2018 CEO pay package, worth around $56 billion, on the grounds that Musk controlled the company and the board’s compensation committee misled shareholders. The court’s ruling was a significant blow to Musk’s authority and credibility.

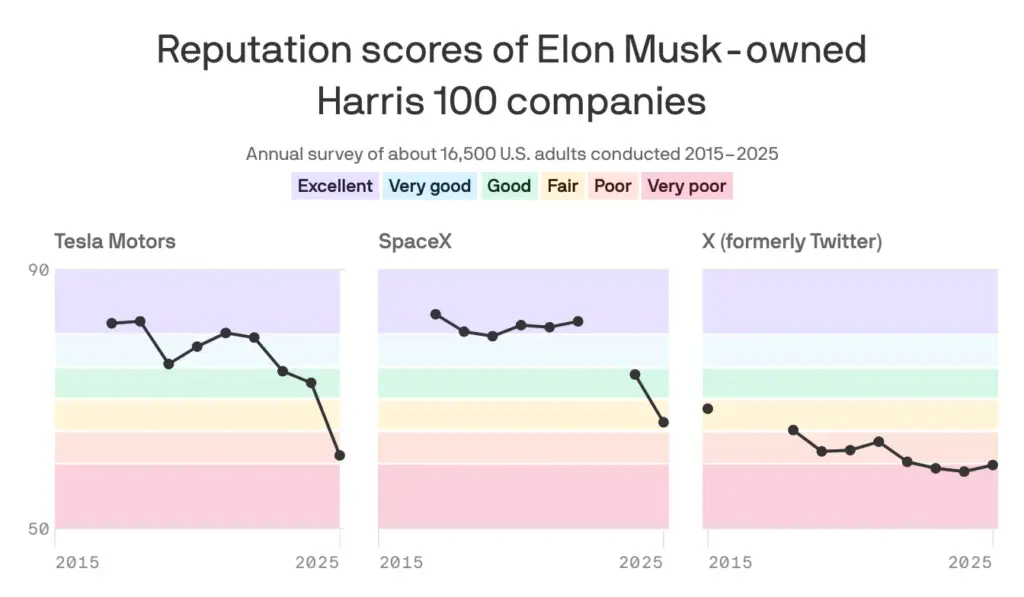

The decline in Tesla’s brand value and reputation since 2024 can be attributed largely to Musk’s incendiary rhetoric and political activities. His nearly $300 million investment in an effort to get Donald Trump re-elected, as well as his endorsement of Germany’s far-right AfD party, have damaged the company’s image.

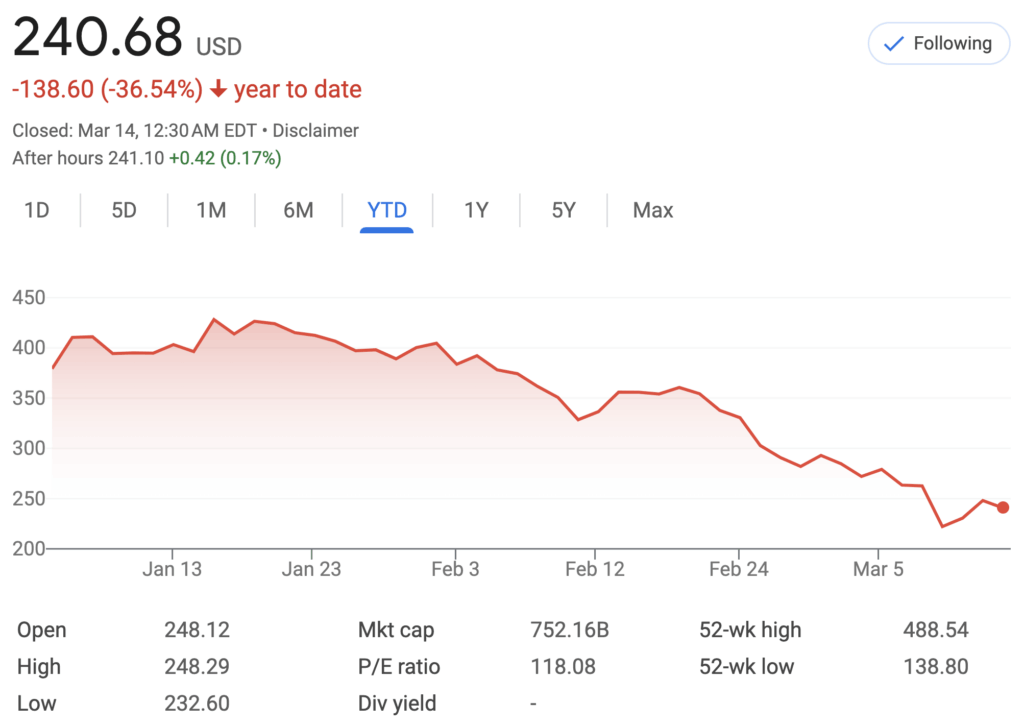

The data is stark: Tesla has plummeted from eighth to 95th in the Axios Harris Poll of public perceptions of the most visible U.S. companies, behind six other automakers. The stock price has declined by 12% this year, while the Nasdaq has dropped only 1%. Moreover, Tesla’s monthly sales across Europe have experienced a nearly 50% decline in April compared to last year, extending the steep declines seen in the first quarter.

The investors who signed the letter own approximately 7.9 million shares in the company combined and blame a board that is “unwilling to act in the best interest of all Tesla shareholders” for Musk’s lack of full-time attention on the company. They are joined by prominent figures like New York City Comptroller Brad Lander, Oregon State Treasurer Elizabeth Steiner, and labor organizations such as SOC Investment Group and the American Federation of Teachers.

In response, Musk has announced plans to focus more on his businesses, including xAI and SpaceX, in addition to Tesla. The investors’ demands for a new independent director with no personal ties to other board members have been partially addressed by the recent appointment of former Chipotle CFO Jack Hartung, who previously worked with Musk’s brother, Kimbal Musk.

The crisis at Tesla is a stark reminder that even the most innovative and influential companies can falter without effective leadership and strategic decision-making. As the world waits with bated breath to see how Elon Musk will respond to these demands, one thing is clear: the future of Tesla hangs in the balance.

Additional Details: